20 Recommended Facts To Picking AI Stock Predictions Analysis Websites

Top 10 Tips For Assessing The Market Coverage For Ai Stock Predicting/Analyzing Trading PlatformsMarket coverage plays a crucial aspect in evaluating an AI software for stock prediction and analysis because it determines your ability to access a vast range of assets and financial markets. A platform that has extensive market coverage allows you to diversify your portfolio, look for global opportunities, and adapt to a variety of trading strategies. Here are 10 top tips to help you evaluate the market coverage offered by these platforms.

1. Evaluate Supported Asset Classes

Stocks: Ensure your platform supports major stock exchanges such as NYSE, NASDAQ LSE and HKEX, and that it includes small, mid and large-cap stocks.

ETFs. Check that the platform offers a variety of ETFs so you can get diversified exposure.

Options and futures. Make sure that the platform is compatible with derivatives such options, futures, and leveraged instruments.

Forex and commodities: Check whether the platform is compatible with the forex pair, precious metals, energy commodities and agricultural products.

Cryptocurrencies: Find out if the platform supports major copyright (e.g., Bitcoin, Ethereum) and altcoins.

2. Check the coverage of your area.

Global markets: The platform should be able to cover the major global markets, including North America and Europe, Asia-Pacific and emerging markets.

Regional focus: Determine whether your platform has a particular focus on a region or market that aligns to your trading needs.

Local exchanges: Make sure you know whether the platform supports regional or local exchanges that are relevant to your area or your strategy.

3. Compare Real-Time Data with Delayed Data Delayed data

Real-time Data: Make sure that the platform has real-time data for trading and for making timely decisions.

Data that has been delayed: Check whether the delayed data is accessible for free or at a discounted price, which could suffice for investors with a long-term view.

Data latency. Examine if your platform minimizes latency in real-time data feeds.

4. Evaluate Historical Data Availability

In depth and breadth of historical data: Make sure that your platform is equipped with extensive historical data available (e.g. for at least 10 years) for backtesting.

The granularity of the data: Determine if the historical data includes daily, intraday weekly, monthly, and daily level of granularity.

Corporate actions: Examine to determine if the data has been recorded prior to. Dividends or stock splits all other corporate actions need to be included.

5. Examine Market Depth and Order Book Data

Platforms must provide Level 2 Data (order-book depth) to help improve price detection and execution.

Check the bid-ask ranges to confirm the accuracy of pricing.

Volume data: Make sure the platform provides detailed information on volume to analyze market activity and liquidity.

6. Assess Coverage for Indices and Sectors

Major indices: Check that the platform contains major indices for benchmarking, index-based strategies and other uses (e.g. S&P 500, NASDAQ 100, FTSE 100).

Sector-specific data: Check whether the platform has data for specific sectors (e.g. technology health, energy, etc.)) for targeted analysis.

Custom indexes: Check whether the platform supports creating or tracking custom indices that meet your preferences.

7. Evaluate integration with News and Sentiment

Feeds for news: Make sure the platform is able to provide live feeds of news from reliable sources, like Bloomberg and Reuters for events that affect the market.

Sentiment analysis: Determine whether there are tools available for sentiment analysis based on social media posts, news articles or other data sources.

Event-driven strategies (e.g. economic announcements, earnings announcements) Verify if your platform supports trading strategies that rely on events.

8. Verify Multi-Market Trading Capability

Cross-market Trading: Verify that the platform allows you to trade across multiple market segments and asset classes using a unified interface.

Conversion of currencies: Find out if the platform offers multi-currency and automatic conversion of currencies for international trade.

Time zone support: Find out whether the trading platform you are using is compatible with various time zones for global markets.

9. Check out alternative data sources

Look for other data sources.

ESG data: Determine if the platform has environmental Governance, Social and Governance (ESG), or other data that can help investors make socially responsible decisions.

Macroeconomic data: Check that the platform provides macroeconomic indicators to conduct fundamental analysis (e.g. GDP, inflation rates, rate of interest).

Review Market Reputation and User Reviews

Feedback from users is an excellent method of evaluating the market reach of a platform.

Find out about the platform's industry reputation. This includes recognition and awards from experts in the industry.

Testimonials and case studies They will showcase the platform's performance in certain market segments or asset classes.

Bonus Tips:

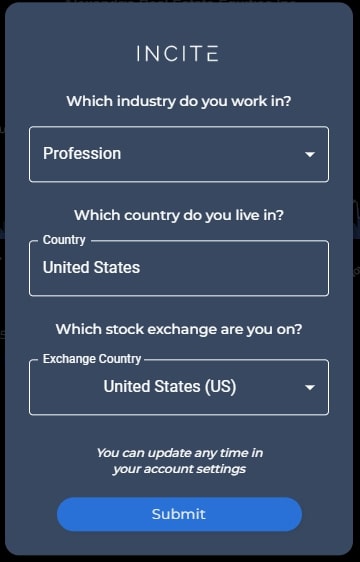

Trial period: Test the platform at no cost to determine if it covers the market and the types of data available.

API access: Verify that your platform's API can access market data in a programmatic manner to run custom analyses.

Support for customers. Check that the platform provides assistance in relation to data or market inquiries.

With these suggestions to evaluate the market coverage of AI trading platforms that predict or analyze stocks Be sure to select one that has access to the markets and information you need to be successful in trading. Market coverage is important to diversify portfolios, discover new opportunities, and adjust to market conditions. Read the top rated trading with ai recommendations for blog tips including ai chart analysis, ai chart analysis, options ai, best ai trading software, ai stock picker, ai investing, ai trade, options ai, ai chart analysis, ai for trading and more.

Top 10 Tips For Evaluating The Reputation & Reviews Of Ai-Powered Trading Platforms

In order to guarantee accuracy, reliability, trustworthiness, and reliability it is important to look over the reviews and reputation of AI-driven stock trading and prediction platforms. These are the top 10 tips to examine their reputation as well as reviews:

1. Check Independent Review Platforms

Look at reviews on trustworthy platforms such as G2, copyright or Capterra.

Why? Independent platforms allow users to give feedback that is unbiased.

2. Analyze Case Studies and User Testimonials

Tip: Read user testimonials and case studies on the platform's website or on third-party websites.

The reason: They offer insight into real-world performance as well as user satisfaction and the like.

3. Evaluate Expert Opinions and Industry Recognition

Tips. Find out if the platform is approved or reviewed by experts in the industry or financial analysts, reliable magazines or other publications.

Expert endorsements lend credibility to claims made by the platform.

4. Social Media Sentiment

Tip: Monitor social media platforms like Twitter, LinkedIn or Reddit to see comments and opinions from users.

Social media gives you a opportunity to share your opinions and news that are not filtered.

5. Verify that the Regulatory Compliance is in place

Verify that your platform is compliant to financial regulations such as SEC and FINRA, or regulations on privacy of data, such as GDPR.

Why: Compliance ensures that the platform functions legally and with integrity.

6. Transparency of Performance Metrics

Tip: Assess whether the platform is transparent in its performance metrics (e.g., rate of accuracy, ROI, backtesting results).

Transparency improves trust among users, and it helps them evaluate the performance of the platform.

7. Consider Customer Service Quality

Read the reviews to get information about customer service and its efficiency.

The reason: Having dependable support is crucial to solving user issues and providing an overall positive experience.

8. Look for Red Flags in Reviews

Tips: Be on the lookout for frequent complaints, including low performance, hidden charges or a lack of updates.

Why: Consistently negative feedback may indicate issues on the platform.

9. Study user engagement and community

Tip: Check if the platform is active in its community of users (e.g. forums, forums, Discord groups) and interacts with users frequently.

Why? A robust and active community indicates high levels of user satisfaction.

10. Check out the history of the company.

Find out the history of the company including leadership, previous performance and prior achievements in the financial tech space.

Why: A proven track record improves the confidence in the platform's reliability and experience.

Compare Multiple Platforms

Compare the reviews and reputation of various platforms to determine which platform is the best fit for your requirements.

These guidelines will allow you evaluate thoroughly the reputation and reviews for AI platforms for stock prediction and trading platforms. This will help you choose a reliable and efficient solution. See the most popular https://www.inciteai.com/advisors for website recommendations including trading ai tool, ai for trading stocks, ai in stock market, invest ai, ai share trading, ai tools for trading, ai trading tool, ai in stock market, ai stock investing, ai trading tool and more.